Alpha Announces Second Quarter 2023 Financial Results

• Reports second quarter net income of $181.4 million, or $12.16 per diluted share

• Posts Adjusted EBITDA of $258.5 million for the quarter

• Maintains robust progress of share buyback program by returning more than $850 million to shareholders since program inception as of July 31, 2023, with nearly $350 million in board authorization remaining

• Declares quarterly dividend of $0.50 per share

• Announces board decision to cease fixed dividend program at year end, consolidating focus and exclusive capital return priority to the share buyback program

• Reduces full-year volume guidance for thermal coal within the Met segment to 1.0 million to 1.4 million tons

BRISTOL, Tenn., August 4, 2023 – Alpha Metallurgical Resources, Inc. (NYSE: AMR), a leading U.S. supplier of metallurgical products for the steel industry, today reported financial results for the second quarter ending June 30, 2023.

(millions, except per share)

| Three months ended June 30, 2023 | Three months ended Mar. 31, 2023 | Three months ended June 30, 2022 | |

|---|---|---|---|

| Net income | $181.4 | $270.8 | $574.2 |

| Net income per diluted share | $12.16 | $17.01 | $29.97 |

| Adjusted EBITDA(1) | $258.5 | $354.4 | $692.9 |

| Operating cash flow | $317.2 | $177.4 | $465.9 |

| Capital expenditures | ($54.9) | ($74.2) | ($41.9) |

| Tons of coal sold | 4.3 | 3.9 | 4.3 |

__________________________________

1. These are non-GAAP financial measures. A reconciliation of Net Income to Adjusted EBITDA is included in tables accompanying the financial schedules.

“Our team successfully navigated some challenges in the quarter, as we announced in late June,” said Andy Eidson, Alpha’s chief executive officer. “The resulting shipment delays, coupled with the continued decline of metallurgical indices, influenced our results for the second quarter. Even with some challenging circumstances to overcome, our teams performed well this quarter and they safely and swiftly addressed the issues we experienced.”

Eidson continued: “In addition to executing on our safety and operational performance expectations, our share buyback program remains a high priority and an area where we have delivered significant progress. As of the end of July, we have cumulatively repurchased over $850 million dollars’ worth of our common stock since the buyback program’s inception, which represents approximately 30% of shares outstanding at the start of the program. Building on the success of our share repurchase program, the board has decided to cease our fixed dividend program after the next quarterly dividend declaration and payment, both of which we expect to occur before year end. This move consolidates our focus, bolstering the already-robust share repurchase program by allowing all available capital return dollars to flow into our buyback program, subject, as always, to market conditions, the trading price of our stock, and our evaluation of the expected return on investment of future share purchases.”

Financial Performance

Alpha reported net income of $181.4 million, or $12.16 per diluted share, for the second quarter 2023, as compared to net income of $270.8 million, or $17.01 per diluted share, in the first quarter.

For the second quarter, total Adjusted EBITDA was $258.5 million, compared to $354.4 million in the first quarter.

Coal Revenues

| (millions) | Three months ended June 30, 2023 | Three months ended Mar 31, 2023 |

|---|---|---|

| Met Segment | $834.0 | $887.0 |

| All Other | $19.8 | $19.7 |

| Met Segment (excl. freight & handling)(1) | $715.8 | $780.8 |

| All Other (excl. freight & handling)(1) | $19.8 | $19.5 |

Tons Sold

| (millions) | Three months ended June 30, 2023 | Three months ended Mar. 31, 2023 |

|---|---|---|

| Met Segment | 4.1 | 3.7 |

| All Other | 0.2 | 0.2 |

__________________________________

1. Represents Non-GAAP coal revenues which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Coal Sales Realization(1)

| (per ton) | Three months ended June 30, 2023 | Three months ended Mar. 31, 2023 |

|---|---|---|

| Met Segment | $172.51 | $208.93 |

| All Other | $99.66 | $109.36 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Second quarter net realized pricing for the Met segment was $172.51 per ton and net realization in the All Other category was $99.66 per ton.

The table below provides a breakdown of our Met segment coal sold in the second quarter by pricing mechanism.

(in millions, except per ton data)

Three months ended June 30, 2023

| Met Segment Sales | Tons Sold | Coal Revenues | Realization/ton(1) | % of Met Tons Sold |

|---|---|---|---|---|

| Export - Other Pricing Mechanisms | 1.5 | $271.1 | $175.69 | 39% |

| Domestic | 1.1 | $222.3 | $193.98 | 29% |

| Export - Australian Indexed | 1.2 | $194.4 | $159.62 | 32% |

| Total Met Coal Revenues | 3.9 | $687.8 | $176.04 | 100% |

| Thermal Coal Revenues | 0.2 | $28.0 | $115.50 | |

| Total Met Segment Coal Revenues (excl. freight & handling)(1) | 4.1 | $715.8 | $172.51 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Cost of Coal Sales

| (in millions, except per ton data) | Three months ended June 30, 2023 | Three months ended Mar. 31, 2023 |

|---|---|---|

| Cost of Coal Sales | $583.5 | $539.1 |

| Cost of Coal Sales (excl. freight & handling/idle)(1) | $458.9 | $426.5 |

| (per ton) | ||

|---|---|---|

| Met Segment(1) | $106.35 | $110.56 |

| All Other(1) | $88.59 | $74.69 |

__________________________________

1. Represents Non-GAAP cost of coal sales and Non-GAAP cost of coal sales per ton which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Alpha’s Met segment cost of coal sales improved to an average of $106.35 per ton in the second quarter, compared to $110.56 per ton in the first quarter of 2023. Cost of coal sales for the All Other category increased to $88.59 per ton in the second quarter, compared to $74.69 per ton in the first quarter. Higher costs in the quarter are due largely to expected inefficiencies associated with the Slabcamp mine’s approaching end of life.

Liquidity and Capital Resources

Cash provided by operating activities in the second quarter increased to $317.2 million as compared to $177.4 million in the first quarter. The second quarter operating cash flows were positively impacted by a decrease in working capital of $81.8 million. The primary driver was a reduction in accounts receivable. Capital expenditures for the second quarter were $54.9 million compared to $74.2 million for the first quarter.

As of June 30, 2023, the company had total liquidity of $405.5 million, including cash and cash equivalents of $312.4 million and $93.1 million of unused availability under the ABL. The future available capacity under the ABL is subject to inventory and accounts receivable collateral requirements and the maintenance of certain financial ratios. As of June 30, 2023, the company had no borrowings and $61.9 million in letters of credit outstanding under the ABL. Total long-term debt, including the current portion of long-term debt as of June 30, 2023, was $11.2 million and consists primarily of equipment financing obligations.

Dividend Program

On August 2, 2023, Alpha’s board of directors declared a quarterly cash dividend payment of $0.50 per share, which will become payable on October 3, 2023 for holders of record as of September 15, 2023.

To fully focus the company’s capital return efforts on its share buyback program, Alpha’s board has decided to cease the fixed dividend program following the next quarterly dividend, expected to be declared and paid in fourth quarter 2023, which will depend on Alpha’s future earnings and financial condition and other relevant factors.

Share Repurchase Program

As previously announced, Alpha’s board of directors authorized a share repurchase program allowing for the expenditure of up to $1.2 billion for the repurchase of the company’s common stock. As of July 31, 2023, the company has acquired approximately 5.7 million shares of common stock at a cost of approximately $850 million. The number of common stock shares outstanding as of July 31, 2023 was 13,687,474, not including the potentially dilutive effect of unvested equity awards.

The timing and amount of share repurchases will continue to be determined by the company’s management based on its evaluation of market conditions, the trading price of the stock, applicable legal requirements, compliance with the provisions of the company’s debt agreements, and other factors.

Operational Update

As previously announced in June, Alpha temporarily halted production as a safety precaution at the Road Fork 52 Mine due to a ventilation issue likely stemming from a previously mined and worked-out area. Ventilation adjustments were made and acceptable air quality levels were reestablished in the mine, which was temporarily shut down for approximately six days. This resulted in the delayed shipment of coal to customers, who received force majeure letters notifying them of these circumstances. The Road Fork 52 Mine is back to normal production levels and Alpha expects to be able to make up the delayed tons impacted by this issue in the third quarter.

A separate and previously announced mechanical failure occurred in June at the Dominion Terminal Associates (DTA) facility in Newport News, Virginia, in which Alpha has a sixty-five percent ownership interest. One of DTA’s stacker/reclaimer machines experienced a mechanical failure that caused it to be inoperable for a period of approximately three days in June while it was repaired and brought back to full capacity. This down time hampered train unloading capability and created related vessel loading delays for roughly 250,000 short tons of Alpha shipments for export customers who received force majeure letters. Alpha fulfilled these shipments in July.

2023 Guidance Adjustment and Performance Update

Alpha is reducing full year 2023 guidance for the thermal coal volumes within the Met segment. The new thermal coal guidance range within the Met segment is 1.0 million to 1.4 million tons, down from the prior range of 1.4 million to 1.8 million tons.

As of July 27, 2023, Alpha has committed and priced approximately 71% of its metallurgical coal within the Met segment at an average price of $189.15 per ton and 100% of thermal coal in the Met segment at an average expected price of $99.67 per ton. In the All Other category the company is 100% committed and priced at an average price of $90.47 per ton.

2023 Guidance

| in millions of tons | Low | High |

|---|---|---|

| Metallurgical | 15.0 | 16.0 |

| Thermal | 1.0 | 1.4 |

| Met Segment | 16.0 | 17.4 |

| All Other | 0.3 | 0.6 |

| Total Shipments | 16.3 | 18.0 |

| Committed/Priced1,2,3 | Committed | Average Price |

|---|---|---|

| Metallurgical - Domestic | $193.11 | |

| Metallurgical - Export | $186.00 | |

| Metallurgical Total | 71% | $189.15 |

| Thermal | 100% | $99.67 |

| Met Segment | 75% | $178.42 |

| All Other | 100% | $90.47 |

| Committed/Unpriced1,3 | Committed | |

|---|---|---|

| Metallurgical Total | 29% | |

| Thermal | --% | |

| Met Segment | 25% | |

| All Other | --% |

| Costs per ton4 | Low | High |

|---|---|---|

| Met Segment | $106.00 | $112.00 |

| All Other | $87.00 | $93.00 |

| In millions (except taxes) | Low | High |

|---|---|---|

| SG&A5 | $59 | $65 |

| Idle Operations Expense | $21 | $31 |

| Cash Interest Expense | $2 | $10 |

| DD&A | $115 | $135 |

| Capital Expenditures | $250 | $280 |

| Tax Rate | 12% | 17% |

Notes:

1. Based on committed and priced coal shipments as of July 27, 2023. Committed percentage based on the midpoint of shipment guidance range.

2. Actual average per-ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per-ton realizations.

3. Includes estimates of future coal shipments based upon contract terms and anticipated delivery schedules. Actual coal shipments may vary from these estimates.

4. Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. These amounts have historically varied and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results.

5. Excludes expenses related to non-cash stock compensation and non-recurring expenses.

Conference Call

The company plans to hold a conference call regarding its second quarter 2023 results on August 4, 2023, at 10:00 a.m. Eastern time. The conference call will be available live on the investor section of the company’s website at https://alphametresources.com/investors. Analysts who would like to participate in the conference call should dial 877-407-0832 (domestic toll-free) or 201-689-8433 (international) approximately 15 minutes prior to start time.

About Alpha Metallurgical Resources

Alpha Metallurgical Resources (NYSE: AMR) is a Tennessee-based mining company with operations across Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Alpha reliably supplies metallurgical products to the steel industry. For more information, visit www.AlphaMetResources.com.

Forward-Looking Statements

This news release includes forward-looking statements. These forward-looking statements are based on Alpha’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Alpha’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Alpha to predict these events or how they may affect Alpha. Except as required by law, Alpha has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Non-GAAP Financial Measures

The discussion below contains “non-GAAP financial measures.” These are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “non-GAAP coal revenues,” “non-GAAP cost of coal sales,” and “non-GAAP coal margin.” We use Adjusted EBITDA to measure the operating performance of our segments and allocate resources to the segments. Adjusted EBITDA does not purport to be an alternative to net income (loss) as a measure of operating performance or any other measure of operating results or liquidity presented in accordance with GAAP. We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. We use non-GAAP cost of coal sales to adjust cost of coal sales to remove freight and handling costs, depreciation, depletion and amortization – production (excluding the depreciation, depletion and amortization related to selling, general and administrative functions), accretion on asset retirement obligations, amortization of acquired intangibles, net, and idled and closed mine costs. Non-GAAP cost of coal sales per ton for our operations is calculated as non-GAAP cost of coal sales divided by tons sold. Non-GAAP coal margin per ton for our coal operations is calculated as non-GAAP coal sales realization per ton for our coal operations less non-GAAP cost of coal sales per ton for our coal operations. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(Amounts in thousands, except share and per share data)

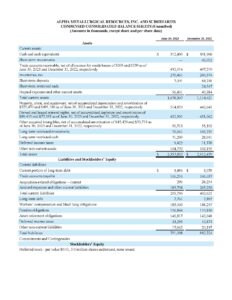

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(Amounts in thousands, except share and per share data)

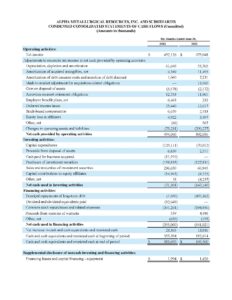

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(Amounts in thousands)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

RESULTS OF OPERATIONS

(In thousands, except for per ton data)