Alpha Announces Financial Results for Fourth Quarter and Full Year 2023

• Posts fourth quarter net income of $176.0 million, or $12.88 per diluted share

• Announces Adjusted EBITDA of $266.3 million for the quarter

• Continues progress on buyback program, with approximately $1.1 billion returned to shareholders since program inception

• Announces changes to company’s board of directors

BRISTOL, Tenn., February 26, 2024 – Alpha Metallurgical Resources, Inc. (NYSE: AMR), a leading U.S. supplier of metallurgical products for the steel industry, today reported financial results for the fourth quarter and full year ending December 31, 2023.

(millions, except per share)

| Three months ended Dec. 31, 2023 | Three months ended Sept. 30, 2023 | Three months ended Dec. 31, 2022 | |

|---|---|---|---|

| Net income | $176.0 | $93.8 | $220.7 |

| Net income per diluted share | $12.88 | $6.65 | $13.37 |

| Adjusted EBITDA(1) | $266.3 | $153.9 | $247.9 |

| Operating cash flow | $199.4 | $157.2 | $185.0 |

| Capital expenditures | ($61.5) | ($54.7) | ($61.0) |

| Tons of coal sold | 4.6 | 4.2 | 3.9 |

__________________________________

1. These are non-GAAP financial measures. A reconciliation of Net Income to Adjusted EBITDA is included in tables accompanying the financial schedules.

“Our fourth quarter results reflect a team effort to finish the year strong, and I’m pleased to report we were successful in that endeavor,” said Andy Eidson, Alpha’s chief executive officer. “Building on this positive momentum, Alpha completed the year having generated over a billion dollars in 2023 Adjusted EBITDA and having invested more than a billion dollars into our share repurchase program since its inception. We did all of this while maintaining better-than-national-average safety and environmental compliance performance and continuing to provide first class service to our customers.”

Financial Performance

Alpha reported net income of $176.0 million, or $12.88 per diluted share, for the fourth quarter 2023, as compared to net income of $93.8 million, or $6.65 per diluted share, in the third quarter.

For the fourth quarter, total Adjusted EBITDA was $266.3 million, compared to $153.9 million in the third quarter.

Coal Revenues

| (millions) | Three months ended Dec. 31, 2023 | Three months ended Sept. 30, 2023 |

|---|---|---|

| Met Segment | $954.2 | $731.5 |

| All Other | $2.9 | $7.5 |

| Met Segment (excl. freight & handling)(1) | $834.6 | $636.7 |

| All Other (excl. freight & handling)(1) | $2.9 | $7.5 |

Tons Sold

| (millions) | Three months ended Dec. 31, 2023 | Three months ended Sept. 30, 2023 |

|---|---|---|

| Met Segment | 4.5 | 4.1 |

| All Other | 0.1 | 0.1 |

_________________

1. Represents Non-GAAP coal revenues which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Coal Sales Realization(1)

| (per ton) | Three months ended Dec. 31, 2023 | Three months ended Sept. 30, 2023 |

|---|---|---|

| Met Segment | $183.76 | $154.73 |

| All Other | $70.14 | $68.32 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Fourth quarter net realized pricing for the Met segment was $183.76 per ton and net realization in the All Other category was $70.14 per ton.

The table below provides a breakdown of our Met segment coal sold in the fourth quarter by pricing mechanism.

(in millions, except per ton data)

Three months ended Dec. 31, 2023

| Met Segment Sales | Tons Sold | Coal Revenues | Realization/ton(1) | % of Met Tons Sold |

|---|---|---|---|---|

| Export - Other Pricing Mechanisms | 1.5 | $264.4 | $175.32 | 37% |

| Domestic | 1.1 | $212.8 | $191.54 | 27% |

| Export - Australian Indexed | 1.5 | $319.0 | $213.41 | 36% |

| Total Met Coal Revenues | 4.1 | $796.2 | $193.54 | 100% |

| Thermal Coal Revenues | 0.4 | $38.4 | $89.76 | |

| Total Met Segment Coal Revenues (excl. freight & handling)(1) | 4.5 | $834.6 | $183.76 |

__________________________________

1. Represents Non-GAAP coal sales realization which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Cost of Coal Sales

| (in millions, except per ton data) | Three months ended Dec. 31, 2023 | Three months ended Sept. 30, 2023 |

|---|---|---|

| Cost of Coal Sales | $668.9 | $564.6 |

| Cost of Coal Sales (excl. freight & handling/idle)(1) | $543.0 | $461.8 |

| (per ton) | ||

|---|---|---|

| Met Segment(1) | $119.00 | $109.95 |

| All Other(1) | $60.07 | $84.73 |

__________________________________

1. Represents Non-GAAP cost of coal sales and Non-GAAP cost of coal sales per ton which is defined and reconciled under “Non-GAAP Financial Measures” and “Results of Operations.”

Alpha’s Met segment cost of coal sales increased to an average of $119.00 per ton in the fourth quarter, compared to $109.95 per ton in the third quarter of 2023. The increase was primarily driven by higher sales-related costs and purchased coal costs, both of which were impacted by higher coal indices during the quarter, as well as higher labor costs. Cost of coal sales for the All Other category improved to $60.07 per ton in the fourth quarter, compared to $84.73 per ton in the third quarter.

Liquidity and Capital Resources

Cash provided by operating activities in the fourth quarter increased to $199.4 million as compared to $157.2 million in the third quarter 2023. Capital expenditures for the fourth quarter were $61.5 million compared to $54.7 million for the third quarter.

As of December 31, 2023, the company had total liquidity of $287.3 million, including cash and cash equivalents of $268.2 million and $94.1 million of unused availability under the ABL, partially offset by a minimum required liquidity of $75.0 million as required by the ABL. As of December 31, 2023, the company had no borrowings and $60.9 million in letters of credit outstanding under the ABL. Total long-term debt, including the current portion of long-term debt as of December 31, 2023, was $10.4 million and consisted primarily of equipment financing obligations.

Share Repurchase Program

As previously announced, Alpha’s board of directors authorized a share repurchase program allowing for the expenditure of up to $1.5 billion for the repurchase of the company’s common stock. As of February 19, 2024, the company has acquired approximately 6.6 million shares of common stock at a cost of approximately $1.1 billion, or approximately $164.87 per share. The number of common stock shares outstanding as of February 19, 2024 was 12,994,558, which includes the impact of 220,067 net shares issued in December 2023 and January 2024. The shares issued in these periods resulted from vestings of previously granted equity awards under the company’s incentive plans. The outstanding share count does not include the potentially dilutive effect of unvested equity awards.

The timing and amount of share repurchases will continue to be determined by the company’s management based on its evaluation of market conditions, the trading price of the stock, applicable legal requirements, compliance with the provisions of the company’s debt agreements, and other factors.

Composition of Alpha’s Board of Directors & 2024 Annual Meeting

Per the company’s corporate governance guidelines, director candidates may not stand for election beyond the age of 75 years. Having reached this age limit, Michael J. Quillen and Albert E. Ferrara, Jr. will not stand for election at the 2024 annual meeting of stockholders and will leave the board, effective before market open on Monday, February 26, 2024, after significant tenures. Mr. Ferrara, the company’s longest-serving director, has served on the board since the company’s formation in July 2016, while Mr. Quillen, who founded predecessor company Alpha Natural Resources in 2002, has served since November 2020. In addition, Elizabeth A. Fessenden, a director since February 2021, has elected to step down from the board, effective before market open on February 26, 2024. None of these departures is a result of disagreements with the company. In connection with these departures, the board has determined to reduce its size from nine directors to seven, effective February 26, 2024.

Additionally, a new director, Shelly Lombard, has been appointed to join the board, effective at market close on February 26, 2024. Ms. Lombard is a financial expert bringing over 35 years of experience in finance on Wall Street and analyzing investments. She has served on a number of publicly traded company boards, including as chair of several audit committees.

“We cannot thank Mike, Al and Liz enough for their service to Alpha and the wisdom they’ve brought to our boardroom,” said David Stetson, board chairman. “Together, the board, management and broader Alpha workforce have achieved incredible success over the last few years. Mike, Al and Liz are to be commended for their involvement in these accomplishments. As we look ahead, we are excited to welcome Shelly to the board. With her deep finance background and market experience, I am confident she will be a valuable contributor.”

Ms. Lombard has been appointed, effective upon joining the board, as chair of the audit committee.

Mr. Gorzynski has been appointed lead independent director, effective February 26, 2024.

Alpha announced the company’s director nominees for the 2024 annual meeting of stockholders: Joanna Baker de Neufville, Kenneth S. Courtis, Andy Eidson, Michael Gorzynski, Shelly Lombard, Danny Smith and David J. Stetson.

The board of directors has scheduled the annual meeting for May 2, 2024.

Operational and Performance Update

As previously announced, due to the 2023 closure of Alpha’s last thermal mine, the company expects all of its 2024 financial activity to be reported within the Met segment. This change is reflected in the following guidance table.

As of February 14, 2024, at the midpoint of guidance, Alpha has committed and priced approximately 35% of its metallurgical coal at an average price of $171.33 per ton and 100% of thermal coal at an average expected price of $77.14 per ton.

2024 Guidance

| in millions of tons | Low | High |

|---|---|---|

| Metallurgical | 15.5 | 16.5 |

| Thermal | 0.9 | 1.3 |

| Met Segment - Total Shipments | 16.4 | 17.8 |

| Committed/Priced1,2,3 | Committed | Average Price |

|---|---|---|

| Metallurgical - Domestic | $161.63 | |

| Metallurgical - Export | $196.05 | |

| Metallurgical Total | 35% | $171.33 |

| Thermal | 100% | $77.14 |

| Met Segment | 40% | $154.68 |

| Committed/Unpriced1,3 | Committed | |

|---|---|---|

| Metallurgical Total | 55% | |

| Thermal | --% | |

| Met Segment | 51% |

| Costs per ton4 | Low | High |

|---|---|---|

| Met Segment | $110.00 | $116.00 |

| In millions (except taxes) | Low | High |

|---|---|---|

| SG&A5 | $60 | $66 |

| Idle Operations Expense | $18 | $28 |

| Net Cash Interest Income | $2 | $8 |

| DD&A | $140 | $160 |

| Capital Expenditures | $210 | $240 |

| Capital Contributions to Equity Affiliates6 | $40 | $50 |

| Tax Rate | 12% | 17% |

Notes:

1. Based on committed and priced coal shipments as of February 14, 2024. Committed percentage based on the midpoint of shipment guidance range.

2. Actual average per-ton realizations on committed and priced tons recognized in future periods may vary based on actual freight expense in future periods relative to assumed freight expense embedded in projected average per-ton realizations.

3. Includes estimates of future coal shipments based upon contract terms and anticipated delivery schedules. Actual coal shipments may vary from these estimates.

4. Note: The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP cost of coal sales per ton sold financial measures to the most directly comparable GAAP measures without unreasonable efforts due to the inherent difficulty in forecasting and quantifying with reasonable accuracy significant items required for the reconciliation. The most directly comparable GAAP measure, GAAP cost of sales, is not accessible without unreasonable efforts on a forward-looking basis. The reconciling items include freight and handling costs, which are a component of GAAP cost of sales. Management is unable to predict without unreasonable efforts freight and handling costs due to uncertainty as to the end market and FOB point for uncommitted sales volumes and the final shipping point for export shipments. These amounts have historically varied and may continue to vary significantly from quarter to quarter and material changes to these items could have a significant effect on our future GAAP results.

5. Excludes expenses related to non-cash stock compensation and non-recurring expenses.

6. Includes contributions to fund normal operations at our DTA export facility and expected capital investments related to the facility upgrades.

Conference Call

The company plans to hold a conference call regarding its fourth quarter and full year 2023 results on February 26, 2024, at 10:00 a.m. Eastern time. The conference call will be available live on the investor section of the company’s website at https://alphametresources.com/investors. Analysts who would like to participate in the conference call should dial 877-407-0832 (domestic toll-free) or 201-689-8433 (international) approximately 15 minutes prior to start time.

About Alpha Metallurgical Resources

Alpha Metallurgical Resources (NYSE: AMR) is a Tennessee-based mining company with operations across Virginia and West Virginia. With customers across the globe, high-quality reserves and significant port capacity, Alpha reliably supplies metallurgical products to the steel industry. For more information, visit www.AlphaMetResources.com.

Forward-Looking Statements

This news release includes forward-looking statements. These forward-looking statements are based on Alpha’s expectations and beliefs concerning future events and involve risks and uncertainties that may cause actual results to differ materially from current expectations. These factors are difficult to predict accurately and may be beyond Alpha’s control. Forward-looking statements in this news release or elsewhere speak only as of the date made. New uncertainties and risks arise from time to time, and it is impossible for Alpha to predict these events or how they may affect Alpha. Except as required by law, Alpha has no duty to, and does not intend to, update or revise the forward-looking statements in this news release or elsewhere after the date this release is issued. In light of these risks and uncertainties, investors should keep in mind that results, events or developments discussed in any forward-looking statement made in this news release may not occur.

FINANCIAL TABLES FOLLOW

Non-GAAP Financial Measures

The discussion below contains “non-GAAP financial measures.” These are financial measures that either exclude or include amounts that are not excluded or included in the most directly comparable measures calculated and presented in accordance with generally accepted accounting principles in the United States (“U.S. GAAP” or “GAAP”). Specifically, we make use of the non-GAAP financial measures “Adjusted EBITDA,” “non-GAAP coal revenues,” “non-GAAP cost of coal sales,” and “non-GAAP coal margin.” We use Adjusted EBITDA to measure the operating performance of our segments and allocate resources to the segments. Adjusted EBITDA does not purport to be an alternative to net income (loss) as a measure of operating performance or any other measure of operating results, financial performance, or liquidity presented in accordance with GAAP. Moreover, this measure is not calculated identically by all companies and therefore may not be comparable to similarly titled measures used by other companies. Adjusted EBITDA is presented because management believes it is a useful indicator of the financial performance of our coal operations. We use non-GAAP coal revenues to present coal revenues generated, excluding freight and handling fulfillment revenues. Non-GAAP coal sales realization per ton for our operations is calculated as non-GAAP coal revenues divided by tons sold. We use non-GAAP cost of coal sales to adjust cost of coal sales to remove freight and handling costs, depreciation, depletion and amortization – production (excluding the depreciation, depletion and amortization related to selling, general and administrative functions), accretion on asset retirement obligations, amortization of acquired intangibles, net, and idled and closed mine costs. Non-GAAP cost of coal sales per ton for our operations is calculated as non-GAAP cost of coal sales divided by tons sold. Non-GAAP coal margin per ton for our coal operations is calculated as non-GAAP coal sales realization per ton for our coal operations less non-GAAP cost of coal sales per ton for our coal operations. The presentation of these measures should not be considered in isolation, or as a substitute for analysis of our results as reported under GAAP.

Management uses non-GAAP financial measures to supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. The definition of these non-GAAP measures may be changed periodically by management to adjust for significant items important to an understanding of operating trends and to adjust for items that may not reflect the trend of future results by excluding transactions that are not indicative of our core operating performance. Furthermore, analogous measures are used by industry analysts to evaluate the Company’s operating performance. Because not all companies use identical calculations, the presentations of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, capital investments and other factors.

Included below are reconciliations of non-GAAP financial measures to GAAP financial measures.

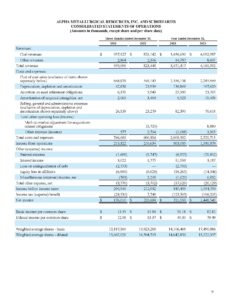

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

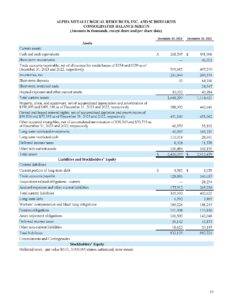

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

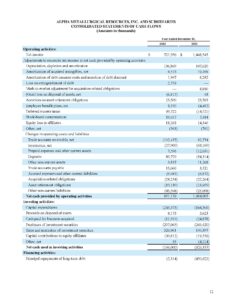

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

ADJUSTED EBITDA RECONCILIATION

(Amounts in thousands)

ALPHA METALLURGICAL RESOURCES, INC. AND SUBSIDIARIES

RESULTS OF OPERATIONS